POPULAR ARTICLES

- Bill of Exchange: Meaning, Format, Types, Features & Examples

- What is Channel Financing: Meaning, Benefits, How It Works & Examples

- Key Difference Between Factoring and Forfaiting

- Supplier Reconciliation: Process, Format, and Best Practices

- Host to Host (H2H) Payment Systems

- Factoring vs Reverse Factoring - Which Benefits Vendors

- Bill Discounting vs Bill Negotiation: Key Differences Explained

- Invoice Discounting Investment in India: Returns, Risks, Benefits & How to Start

- Different sources of working capital financing

- Vendor Onboarding in Indian Businesses: A Complete Guide

- What is Dynamic Discounting? Process, Examples, Pros & Cons Explained

- Invoice Discounting vs Factoring: Key Differences & Uses Explained

- What are Fixed and Floating Charges: Examples and FAQs

- How to account for invoice discounting

RELATED ARTICLES

- What is Accounts Payable - Meaning, Process, Examples, Formula

- Accounts Payable Journal Entry: Types & Examples

- SAP Tcodes for Accounts Payable: SAP Transaction Codes List for Accounts Payable

- Accrued Income Journal Entry: Meaning, Importance, and Examples

- What is Procure to Pay (P2P)? Process, Cycle, Benefits, Best Practices

- What is Bill Discounting: Meaning, Rebate, Types, Process & Examples

- 2-Way & 3-Way Matching in Accounts Payable Explained

- Letter of Credit (LC) Discounting: Process, Interest Rates & Example

- What is TReDS? Meaning, Full Form, Registration, Platforms & MSME Benefits

Bill of Exchange: Meaning, Format, Types, Features & Examples

Most of the business-to-business sales happen on credit. Delivering goods and services on the promise of payment at a future date may sometimes require legal assurances. Bill of exchange serves this purpose. This written contract is essential for the viability of modern cross-border trading of goods and services.

This article discusses the meaning of bill of exchange , its different types and formats with examples.

What is the bill of exchange?

A bill of exchange is a written instruction to pay a pre-specified sum of money at a pre-specified date or on demand. It involves a drawer and a drawee. The drawer is the entity that creates and issues the payment instruction, while the drawee is required to make the payment as per the instruction.

The major use of bills of exchange can be found in international or cross-border trading. Sellers in domestic transactions primarily issue invoices directly to buyers as proof of the sales, as both parties belong to the same legal jurisdiction. In case of non-payment, a seller can pursue the defaulter more easily.

The existence of multiple legal jurisdictions and the applicability of international laws require exporters to ensure substantial legal enforceability in case of delay or default in payments. A bill of exchange, as a written instruction accepted by the drawee (buyer) to make a pre-specified payment at a pre-specified date, offers that legal assurance.

Parties involved in a bill of exchange

Clarity about the parties to a bill of exchange is essential for understanding the legal implications of the document. Each party has different roles to play in fulfilling the underlying transaction.

A bill of exchange for any translation involves two parties: the drawer and the drawee.

- The person who issues a bill of exchange is a ‘drawer’. They are also the seller in the transaction.

- The person to whom the bill of exchange is issued is a ‘drawee’ or the purchaser in that transaction.

Features & characteristics of bill of exchange

The key features and characteristics of a bill of exchange are as follows-

- Written financial instrument - It must be issued in a physical, written document or equivalent electronic format.

- Carries unconditional payment instruction - The payment instruction to the drawee cannot be conditional on the occurrence or fulfilment of any other event.

- Must be undersigned by a drawer - A bill of exchange becomes valid only if it carries the drawer’s signature. Authentication of a bill in digital formats happens through a digital signature or similar technologies.

- Must be accepted by a drawee - The legal enforceability of a bill of exchange becomes stronger only when it is accepted by the drawer or the buyer in the underlying translation.

- Payable to a specific entity or bearer - The drawee is committed to paying the pre-specified sum as ordered in a bill of exchange to the entity mentioned in the bill or to the bearer of the bill.

- Date of payment is pre-specified or on-demand - A valid bill of exchange must mention a date by which the drawee needs to pay the sum. The bill can also order the drawee to pay on demand.

- Transferable by endorsement - This unique characteristic makes it possible to finance a bill of exchange. Endorsing involves the current owner/holder of a bill of exchange signing on the back of the bill. The signature entitles the new holder to receive payment from the drawee. This feature legally validates the discounting and trading of bills of exchange.

How bill of exchange works?

Activities involving a bill of exchange follow the below steps-

Step 1: A drawer (seller) creates a bill of exchange.

Step 2: The bill is presented to the drawee (buyer).

Step 3: The drawee verifies and accepts the bill and returns the same to the drawer.

Step 4: The seller may choose to hold the bill or discount it.

Step 5: If discounted, the seller transfers the bill through endorsement after receiving the discounted amount.

Step 6: The holder of the bill presents it to the drawee at the time of maturity (pre-specified).

Step 7: The drawee pays, and the bill gets honoured.

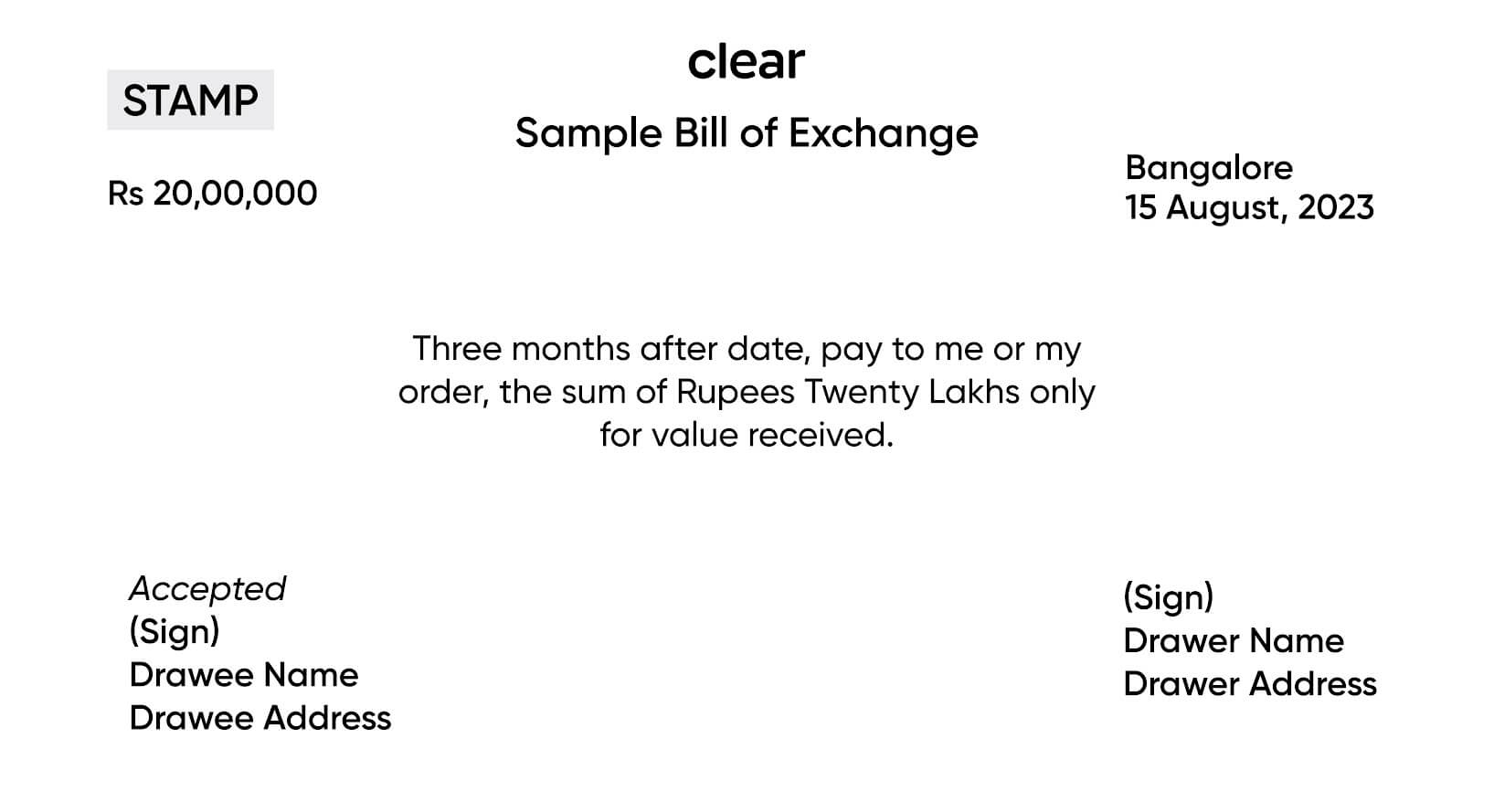

Format and specimen of bill of exchange

The format of a bill of exchange may vary depending on the purpose of the bill. However, a standard example of bill of exchange is as follows.

Example of bill of exchange

Scenario:

Seller - Shiva Enterprise

Buyer - Shabnam Pvt Ltd

Let us assume that Shiva supplies merchandise worth Rs 1,00,000 to Shabnam on credit. The buyer agrees to pay on a credit term of 90 days. To ensure payment safety and legal enforceability of the transaction, Shiva Enterprise issues a bill exchange mentioning the following details:

- Date of purchase - 04/07/2025

- Value - Rs 1,00,000

- Credit period - 90 days

- Payment due date - 04/10/2025

- Instruction - “Pay Rs 1,00,000 to the holder or the bearer on or before 04/10/2025 for the supply made on 04/07/2025.”

- Signature - On behalf of Shiva Enterprise

Upon receiving the bill, Shabnam Pvt Ltd marks “Accepted” on the bill and countersigns it as a formal acknowledgement. On the due date, Shiva submits the bill and Shabnam pays the due amount. Once the payment is received, Shiva marks the bill as received and countersigns it.

Types of bill of exchange

Some of the common types of bills of exchange are,

- Sight bill - Payable on demand or immediately upon presentation of the bill by the holder.

- Time bill - Payable at a pre-specified future date. Also known as Usance bill

- Inland bill - Valid for transactions within a country.

- Foreign bill - Usable for cross-border transactions.

- Documentary bill - This type of bill accompanies shipping documents, like insurance, bill of lading, etc., related to the transaction underlying.

The drawer can receive these documents upon acceptance of delivery or release of payment.

Discounting of bills of exchange

Discounting a bill of exchange is the process of encashing the bill by its drawer or holder without waiting through the credit period to receive the pre-specified payment. This involves the drawer selling and endorsing the bill to a financial institution or an individual investor in exchange for a discounted sum. The discounting rate depends on the time to maturity of the bill, the prevailing bank rate and creditworthiness.

Advantages of a bill of exchange

Some of the substantial advantages of issuing a bill of exchange over other forms of written proof of sales are,

- Once accepted, the drawee of a bill of exchange is legally obligated to make the due payment.

- As a negotiable and legally enforceable written financial instrument that facilitates trade financing. Therefore, it helps sellers manage their working capital liquidity.

- Bill of exchange in international transactions significantly reduces the risks of non-payment.

- A bill of exchange enables precise documentation of the terms of payments without any ambiguity.

Legal section and requirements

In India, a bill of exchange derives its legal validity from the Negotiable Instruments Act of 1881. On the international front, the Geneva Conventions of 1930 and 1931 outline a harmony among the acts governing such instruments across countries.