POPULAR ARTICLES

- Bill of Exchange: Meaning, Format, Types, Features & Examples

- What is Channel Financing: Meaning, Benefits, How It Works & Examples

- Key Difference Between Factoring and Forfaiting

- Supplier Reconciliation: Process, Format, and Best Practices

- Host to Host (H2H) Payment Systems

- Factoring vs Reverse Factoring - Which Benefits Vendors

- Bill Discounting vs Bill Negotiation: Key Differences Explained

- Invoice Discounting Investment in India: Returns, Risks, Benefits & How to Start

- Different sources of working capital financing

- Vendor Onboarding in Indian Businesses: A Complete Guide

- What is Dynamic Discounting? Process, Examples, Pros & Cons Explained

- Invoice Discounting vs Factoring: Key Differences & Uses Explained

- What are Fixed and Floating Charges: Examples and FAQs

- How to account for invoice discounting

RELATED ARTICLES

- What is Accounts Payable - Meaning, Process, Examples, Formula

- Accounts Payable Journal Entry: Types & Examples

- SAP Tcodes for Accounts Payable: SAP Transaction Codes List for Accounts Payable

- Accrued Income Journal Entry: Meaning, Importance, and Examples

- What is Procure to Pay (P2P)? Process, Cycle, Benefits, Best Practices

- What is Bill Discounting: Meaning, Rebate, Types, Process & Examples

- 2-Way & 3-Way Matching in Accounts Payable Explained

- Letter of Credit (LC) Discounting: Process, Interest Rates & Example

- What is TReDS? Meaning, Full Form, Registration, Platforms & MSME Benefits

Difference Between Promissory Note and Bill of Exchange

India's business and money system works on trust and proper written records. Some important documents are used to make sure payments are done on time and there is no confusion,. The three main types are promissory note, bill of exchange, and cheque.

This topic focuses on promissory note and bill of exchange. These are commonly used in trade and finance when money is borrowed or payment is delayed. Both are written under the law called the Negotiable Instruments Act, 1881. Knowing about them helps in understanding how legal payments work in business.

What is a Promissory Note?

A promissory note is a written paper (kind of agreement) where one person writes that he will pay money to another person. The amount is fixed , like ₹5,000 or ₹10,000. The payment can be made on demand or after a fixed date (depends on what is written).

It also has details like → how much money, when to pay, interest (if written), and signatures. Both the parties involved — the one who gives and the one who takes — must sign it.

Basically, it shows that money is to be paid. That’s why it's important.

Uses of Promissory Note

A promissory note is useful in many cases where money is given from one person to another. It helps to keep things clear. The uses are as follows:

- When someone gives a loan to another person, they can write a promissory note.

- It shows how much money is to be returned and when.

- If there is any fight, it can be used as proof.

- People use it so that no one forgets the payment date.

- It is also used by shops and business people sometimes.

- It can be for small money or a big loan .

Promissory Note Example

Ravi borrowed ₹10,000 from Suresh and wrote on paper — "I promise to pay ₹10,000 to Suresh on 1st August 2025." He signed it. This is a promissory note.

What is the Bill of Exchange?

A bill of exchange is a written note where one person (called the drawer) tells another person (the drawee) to pay money to a third person (the payee). The amount is already fixed. The payment can be on a fixed date or even on demand.

There are three parties involved in this. The person who writes it, who has to pay, and who will receive the money.

The drawee has to accept it, otherwise it won’t work properly.

Uses of Bill of Exchange

A Bill of Exchange is used in many monetary and trade situations. Its uses are:

- It is used in trade to pay for goods or services after some time.

- It gives the seller a written promise from the buyer to pay on a fixed date.

- It can be transferred to someone else by signing on the back (endorsement).

- The seller can give it to the bank and get money before the due date (discounting).

- It works as legal proof if the buyer doesn’t pay.

Bill of Exchange Example

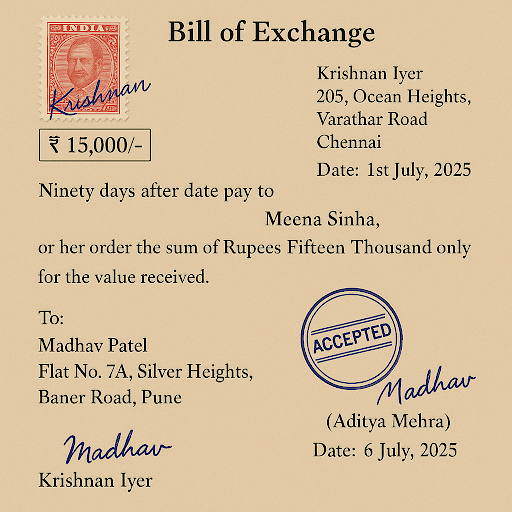

Example: Bill of Exchange

Key Differences Between Promissory Note and Bill of Exchange

Here are the main differences between a Promissory Note and a Bill of Exchange:

Aspect | Promissory Note | Bill of Exchange |

| Nature | A promise to pay | An order to pay |

| Parties | 2 (maker and payee) | 3 (drawer, drawee, payee) |

| Acceptance | Not required | Drawee must accept it |

| Liability | Maker is directly responsible | Drawee is liable after acceptance; drawer is liable before |

| Transferability | Can be endorsed | Can be endorsed |

| Used by | Borrowers (personal or business) | Traders (domestic or international trade) |

| Proof if not paid | Can be used in court as proof | Can be protested and used in court |

| Dishonor | Notice of dishonor not compulsory | Notice of dishonor must be given to the drawer and endorsers |

| Issued by | The debtor (maker) | The creditor (drawer) |

| Copies allowed | No | Yes |

Similarities Between Promissory Note and Bill of Exchange

Here are the key similarities between a Promissory Note and a Bill of Exchange:

Aspect | Similarity |

| Evidence of debt | Both are written documents that acknowledge a debt and a promise or order to pay a specific amount. |

| Negotiable instruments | Both can be transferred to others by endorsement or delivery, making them negotiable. |

| Essential details | Require inclusion of crucial elements like amount, date, payee, and signatures. |

| Legal framework | Both are covered under the Indian Negotiable Instruments Act, 1881. |

| Court enforceability | Both are legally enforceable, allowing holders to take legal action if payment is defaulted. |