POPULAR ARTICLES

- Bill of Exchange: Meaning, Format, Types, Features & Examples

- What is Channel Financing: Meaning, Benefits, How It Works & Examples

- Key Difference Between Factoring and Forfaiting

- Supplier Reconciliation: Process, Format, and Best Practices

- Host to Host (H2H) Payment Systems

- Factoring vs Reverse Factoring - Which Benefits Vendors

- Bill Discounting vs Bill Negotiation: Key Differences Explained

- Invoice Discounting Investment in India: Returns, Risks, Benefits & How to Start

- Different sources of working capital financing

- Vendor Onboarding in Indian Businesses: A Complete Guide

- What is Dynamic Discounting? Process, Examples, Pros & Cons Explained

- Invoice Discounting vs Factoring: Key Differences & Uses Explained

- What are Fixed and Floating Charges: Examples and FAQs

- How to account for invoice discounting

RELATED ARTICLES

- What is Accounts Payable - Meaning, Process, Examples, Formula

- Accounts Payable Journal Entry: Types & Examples

- SAP Tcodes for Accounts Payable: SAP Transaction Codes List for Accounts Payable

- Accrued Income Journal Entry: Meaning, Importance, and Examples

- What is Procure to Pay (P2P)? Process, Cycle, Benefits, Best Practices

- What is Bill Discounting: Meaning, Rebate, Types, Process & Examples

- 2-Way & 3-Way Matching in Accounts Payable Explained

- Letter of Credit (LC) Discounting: Process, Interest Rates & Example

- What is TReDS? Meaning, Full Form, Registration, Platforms & MSME Benefits

What is Bill Discounting: Meaning, Rebate, Types, Process & Examples

Bill discounting is a popular financing technique in India, which you can choose for short-term finance. Bill discounting is simple- Sell unpaid invoices or bills to a bank or financial institution at a discounted price rather than waiting for your customer to pay on the due date. It enables a seamless way to manage cash flows, converting unpaid invoices into working capital for your enterprise.

Dive into this article for details about how bill discounting works, the umpteen benefits it unlocks for your enterprise, along with the potential risks associated. By the end of this article, you will understand the following-

- Meaning of bill discounting and its importance

- How bill discounting works

- Examples of bill discounting

- Benefits of bill discounting for your enterprise

- Risks associated with bill discounting

What is Bill Discounting?

Simply explained, bill discounting is a financing method to get early payment for your credit-based sales invoices. It could also be referred to as invoice discounting, involving a bank or financial institution as the finance provider.

Bill Discounting Example

To give you a bill discounting example, imagine yourself as a seller who has made credit sales worth Rs.10,00,000 to a certain customer or buyer. The bill is due for payment after 90 days. You may need money much before the due date, say on the 30th day, for working capital needs. So, you can approach a bank/financial institution/NBFC and it finances you today based on the account receivables/trade receivables due at a later date.

The invoice is verified, and payment is released to the buyer for Rs.9,85,000, at a discount. On the due date after 90 days, the buyer pays the full amount, Rs.10,00,000 to the bank. The differential amount of discount, Rs.15,000 withheld by the bank, is nothing but their commission/interest charge. This refers to bill discounting.

What is the Rebate on Bills Discounted?

Rebate on discounted bills refers to the refund of the discount or interest charge by the bank when the customer settles the invoice well before the due date. When a bank gives you money upfront for your unpaid invoice, it charges some interest for the time until the invoice's due date. If the invoice is paid back by the buyer before its original maturity, the bank returns the extra interest for the unused period to the seller. Such a returned amount is called the rebate on bills discounted.

In the above example, suppose the buyer makes early repayment on the 60th day. Considering 6% interest is the charge by the bank, it will refund Rs.4,930 to the seller (Rs.10,00,000 × 6% × (30 ÷ 365)) for the unused period of 30 days (90-60).

Eligibility Criteria for Bill Discounting

The eligibility criteria for bill discounting can vary with every bank/financial institution. Bill discounting requires certain conditions to be fulfilled as sellers-

- The documented contract and payment agreement should be agreed upon by both parties.

- The fixed date upon which the payment will be due, as promised by the customer, must be clear.

- The business is legally registered and must operate in the region or country of registration.

- Banks or financial institutions expect the business to be operating for a minimum period of 6–12 months. Some banks also impose a condition requiring a minimum turnover/revenue limit for bill discounting. Many institutions also specify a minimum value for an invoice to qualify for bill discounting. The TReDS Platform can be used by any MSME with minimal documentation.

- Good credit history of both the seller and the buyer. Most banking institutions look for a credit score of 650 or more.

- The presence of valid, recent, and undisputed invoices is essential. Invoices must also be for actual completed sales with proof. You must also submit the invoice raised by the customer for the pending payment.

- The financial stability of the seller is checked with documents such as the audited balance sheets and profit & loss statements.

- Provide required documents (invoice, KYC, GST returns, delivery proof, sale contract for goods).

Types of Bill Discounting

There are several types of bill discounting popular in India, explained below-

- Disclosed Bill Discounting (Standard Discounting)- It is a type of bill discounting where all parties (seller, buyer and financiers) are aware of the bill discounting arrangement.

- Undisclosed Bill Discounting (Confidential Discounting)- This type of bill discounting occurs when the buyer is not informed of the bill discounting. So when payment is made, it is made to an account managed by a bank, keeping its details confidential.

- Full Turnover Bill Discounting (Whole Turnover Discounting)- This type of bill discounting involves discounting all sales invoices or receivables for a specific period with a bank. In this arrangement, there is less control over which invoices are discounted, but it gives a steady source of cash inflow.

- Partial Turnover Bill Discounting (Selective Discounting)- The seller selects particular invoices for bill discounting in this type. It is more flexible with greater control for the seller.

- Clean Bill Discounting- In this type, a seller receives an amount for bill discounting without needing to provide supporting documents, making it a fast bill discounting arrangement. However, the financier bears a high risk due to the lack of those extra documents.

- LC-backed Bill Discounting (Letter of Credit-backed)- Wherever the bill discounting is secured against a letter of credit issued by the buyer’s bank, it is called LC-backed bill discounting. It is prominently used in international trade.

- Recourse Bill Discounting- The bill discounting takes place with a recourse that the seller will compensate when the buyer defaults settlement of the invoice to the financier.

- Non-recourse Bill Discounting- The bill discounting takes place without recourse. Here, the financier bears the complete risk of buyer default, and it involves a high cost as compared to the recourse bill discounting.

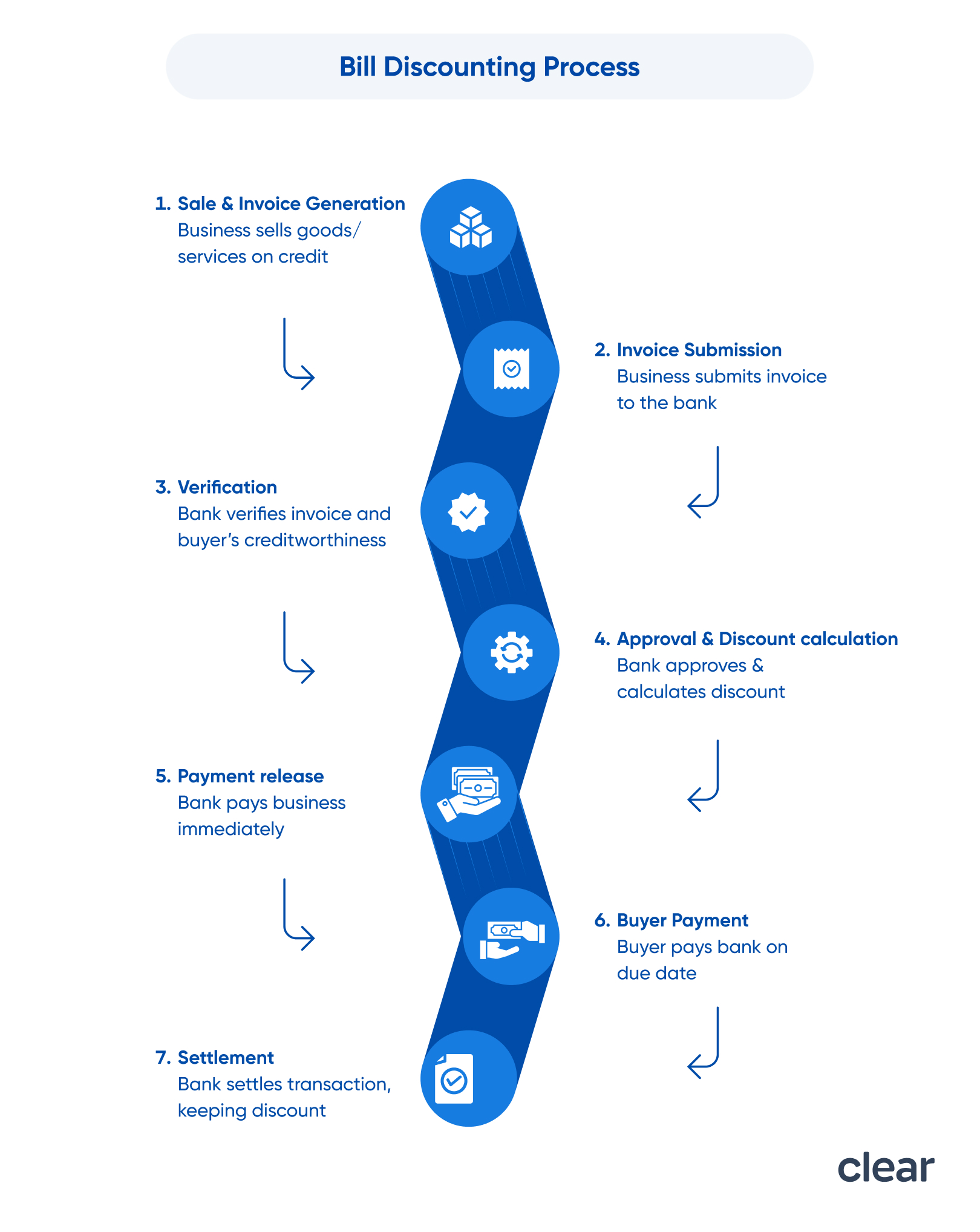

Bill Discounting Process

Bill Discounting Procedure involves a few simple steps. The process begins with the sale of goods or services and ends with the settlement of the invoice. Let’s understand with the help of the flowchart-

Bill Discounting Formula

The basic formula for bill discounting while computing the discount or the bank's interest charge is as follows-

Discount = (Invoice Amount×Discount Rate×Number of Days)/365

Where:

- Invoice amount refers to the face value of the bill or invoice.

- Discount rate is the annual interest/discount rate (expressed as a decimal).

- Number of days is the period from the discounting date until the bill’s due date.

The amount the business receives immediately is:

Amount received=Invoice amount−Discount

Bill Discounting Platforms in India

Bill discounting platforms allow buyers and financiers to collaborate for bill discounting arrangements. These include government-backed initiatives and private players. Some of the popular bill discounting platforms are given below-

- TReDS (Trade Receivables Discounting System)- Regulated by the RBI, this digital marketplace facilitates invoice/bill discounting for MSMEs against large corporate buyers, government departments, and PSUs. The platform ensures timely disbursals and competitive financing rates without any collateral. Some of the examples include M1xchange, Receivables Exchange of India Ltd (RXIL) and Invoicemart.

- National Small Industries Corporation (NSIC) Bill Discounting Scheme- It is a platform targeted for MSMEs selling to reputed public limited companies and government entities. It allows discounted bill financing under certain conditions, including security such as bank guarantees and competitive interest rates.

- Clear Invoice Discounting- A popular private platform offers invoice discounting for maximising EBITDA through early vendor payments and fast ERP integration.

Documents Required for Bill Discounting

Below is a list of the most commonly sought-after documents for bill discounting-

- ID proof – PAN card, Aadhaar, passport, voter ID, or driving license.

- Address proof – Aadhaar, passport, voter ID, etc.

- Business registration proof – GST certificate, incorporation certificate, partnership deed, shop license, etc.

- Financial papers – Audited statements, income tax returns, GST returns, and bank statements.

- Unpaid invoices/bills – Valid and undisputed invoices issued to customers.

- Proof of delivery – Delivery challan/receipt and purchase order copy.

- Bill of exchange/promissory note, if applicable.

- Buyer’s credit details – Proof of the buyer’s payment reliability.

- Application form – Filled and signed, with passport-size photos.

Benefits of Bill Discounting

The following are the benefits of bill discounting for sellers-

- Fast and easy- The documentation required is very minimal. The financial institution grants loans within hours in case of emergencies.

- Collateral-free- No asset is required to be kept as collateral. The loan is granted against unpaid sale invoices.

- Cost-effective lending facility- Bill discounting has two costs, i.e. service cost and discounting charge. The service fee is usually charged as a percentage of the annual turnover, and the discounting charge is the cost of lending money. Despite these two charges, it is considered the most cost-effective lending facility by ensuring quick access to cash.

- Maintains confidentiality- The business has complete control over its sales ledger, and the customer is nowhere in the loop in this type of financing.

Risks of Bill Discounting

Below is a list of common risks involved in bill discounting-

- Credit Risk: There is a risk that the buyer may default on the invoice amount on the due date, causing losses to the financier, prevalent especially in non-recourse bill discounting.

- Invoice Manipulation: There is a risk that the seller may submit forged, duplicated, or fake invoices for discounting, which could result in financial losses.

- Loss of Control over Buyer Relationships: The financier may directly coordinate with the buyer for settlement, potentially harming business relationships with the seller.

- High Costs and Hidden Charges: Discounting fees, administrative costs, and other hidden charges, such as credit check fees, early exit fees, and processing fees, can significantly reduce profit margins.

- Dependence on Invoice Discounting: Overusing bill discounting as a financing method can lead to cash flow dependency and may not be ideal for long-term financing needs.

- Legal and Compliance Risks: Failure to comply with regulatory requirements given by the RBI, Factoring Regulation Act, 2011 and Payment and Settlement Systems (PSS) Act, 2007, can result in fines, legal cases, or annulment of transactions.

- Market and Economic Risks: Economic slowdown or unfavourable market conditions can affect buyer payments and discounting terms.

- Documentation and Verification Risks: Improper or insufficient document verification may expose the financier to risks of non-payment.

- Early Exit Difficulties: Exiting a discounting arrangement prematurely may require full repayment plus charges, causing cash flow strain.